December 3, 2025 — CommasMax, a leading intelligent quantitative trading platform, has announced the launch of its Global Integrated Risk Control Network—an extensive system upgrade designed to deliver stronger real-time risk monitoring, clearer fund transparency, and a more secure automated trading environment for users worldwide.

This development stands as one of the platform’s most significant technological achievements. At a time when global traders are increasingly focused on safety, system reliability, and execution consistency, CommasMax’s new network offers enhanced stability and deeper operational insight across international markets.

Reinforcing Trust Through a Fully Transparent Non-Custodial Model

Since its founding in the United States in 2019, CommasMax has operated under a strict non-custodial framework, ensuring that users retain full authority over their exchange API permissions. Access can be modified or revoked instantly, giving traders complete ownership and control of their assets at all times.

The Global Integrated Risk Control Network strengthens the platform’s signature Non-Custody + Shared Risk structure by increasing transparency in strategy execution, fund flow monitoring, and risk evaluation. This design drastically reduces the structural exposures commonly found in custodial trading platforms.

Global Coverage Backed by Institutional-Grade Monitoring Tools

At the core of this new network is a multi-region monitoring architecture supported by real-time strategy traceability and an end-to-end anomaly detection system. These components oversee market dynamics across major financial regions—including the Americas, Europe, and the Asia-Pacific.

Using millisecond-level market analysis and multi-year historical data, the system provides institutional-level risk detection—while maintaining the user-first foundation of non-custodial asset control.

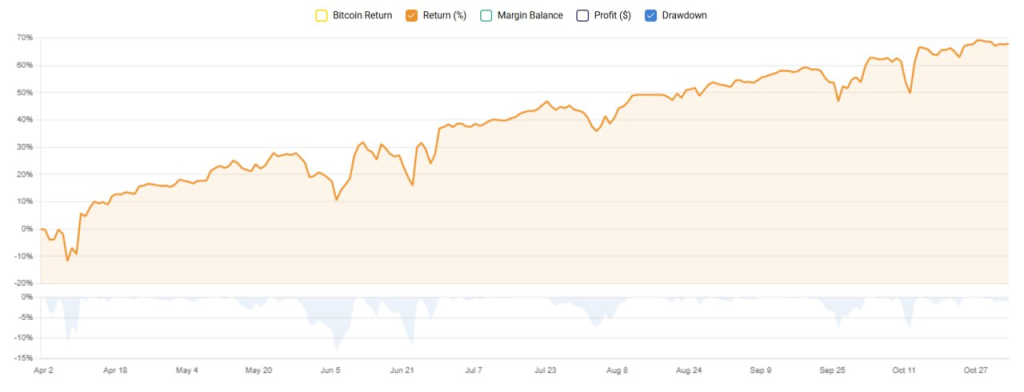

Built on Proven Stability Across Multiple Market Cycles

CommasMax’s trading models have demonstrated consistent performance over numerous live market cycles—navigating bull phases, bear periods, and extreme volatility with stable logic and minimal disruption. This real-world data has been deeply integrated into the architecture of the new risk control system.

The enhanced network now detects both conventional price-based risks and strategy deviation risks, creating a dual-layer safety mechanism designed to prevent sudden, system-wide losses and protect long-term user performance.

Prioritizing User Independence and Full Asset Authority

Industry observers highlight that combining a non-custodial model with a global risk control network greatly elevates user autonomy and operational transparency. Users maintain direct control of their funds on leading exchanges, giving CommasMax authorization exclusively for trade execution—not asset access.

With the ability to pause strategies, revoke permissions, or manually intervene at any time, users gain flexibility and reduced operational risk. Meanwhile, CommasMax’s responsibilities remain clearly defined within execution and monitoring, without any involvement in fund custody.

Future Expansion: Increased Transparency and Intelligent Risk Insights

CommasMax plans to continue expanding the Global Integrated Risk Control Network by introducing additional monitoring nodes and implementing advanced analytical features, including:

- detection of abnormal trading behavior

- cross-exchange liquidity risk tracking

- deeper permission-level security monitoring

- enhanced multi-factor strategy deviation analysis

The platform also intends to roll out user-facing risk visualization dashboards, enabling traders to view live strategy conditions, exposure metrics, and risk interception logs—ensuring end-to-end transparency throughout the trading journey.

About CommasMax

Founded in 2019, CommasMax is an intelligent quantitative trading platform dedicated to providing advanced automated strategies within a secure, non-custodial ecosystem. Its mission is to bring institutional-grade trading technologies and risk management capabilities to retail users around the world.

CoinsMax Trade Tech Ltd

Denver, United States