As crypto finance enters a new era, decentralized finance (DeFi) is no longer defined by speculative yield farming or fleeting token incentives — it’s entering a phase of structural refinement, driven by efficiency. By 2025, the sector’s pulse has shifted from chasing returns to optimizing capital flow, speed, and transparency. At the center of this evolution stands a new frontier — the decentralized derivatives exchange, or Derivatives DEX.

From Yield to Efficiency: DeFi’s Structural Reinvention

In DeFi’s early waves, innovations like liquidity mining, stablecoins, and automated yield strategies fueled the ecosystem’s rapid growth. But as markets matured, the narrative evolved. Between 2023 and 2024, the focus shifted from pure yield to stability — stablecoins, Real World Assets (RWAs), and sustainable yield models. By 2025, DeFi’s attention turned squarely toward capital efficiency: how effectively on-chain liquidity could generate returns without compromising security or transparency.

According to DeFiLlama, global DeFi total value locked (TVL) remained steady between $90–110 billion through 2024. Yet the share of productive assets — those generating continuous cash flows from staking, synthetic assets, or yield-bearing stablecoin strategies — surged from 38% to 63%. Simultaneously, turnover velocity doubled, reflecting a transition from static asset parking to dynamic utilization. The era of passive DeFi is ending; the age of intelligent liquidity has begun.

Capital Efficiency Becomes the New Battleground

In the traditional AMM model, market-making capital utilization hovered between 8–15%.

Under order-book systems and composable margin architectures (such as Hyperliquid and Aevo), that utilization jumps to 45–60% — meaning the same $1 of liquidity now generates 4–6× higher trading throughput.

This efficiency gap is not merely technological — it’s institutional.

CEXs rely on centralized matching and credit leverage, whereas DEXs depend on on-chain structure and protocol-based trust.

Previously, the former won on speed, the latter on transparency.

But post-2025, the market seeks a new equilibrium — a system that offers CEX-level performance without sacrificing decentralization or verifiability.

This is the rise of Performance-Fi — performance-oriented DeFi.

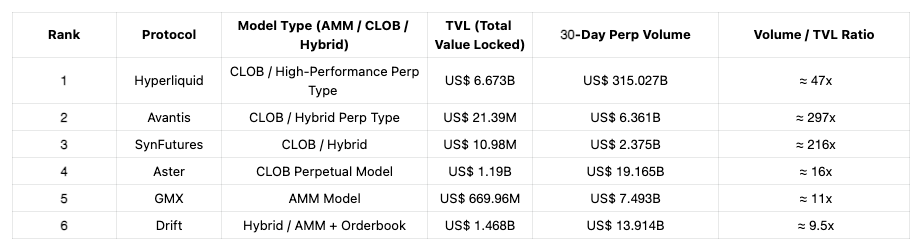

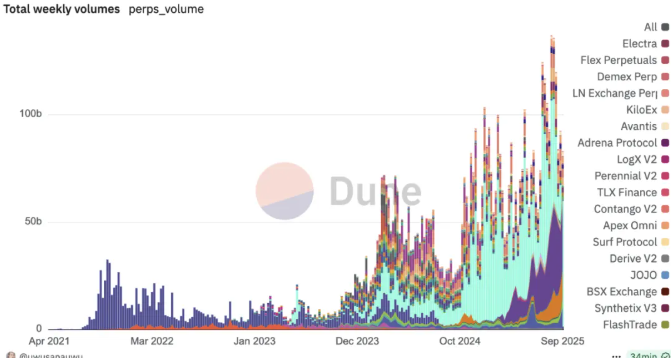

According to DeFiLlama (Sep 2025), weekly global derivatives DEX volume has exceeded $95 B, a 178% year-on-year increase, with Hyperliquid, Aevo, and MUX collectively accounting for over 72% of the total.

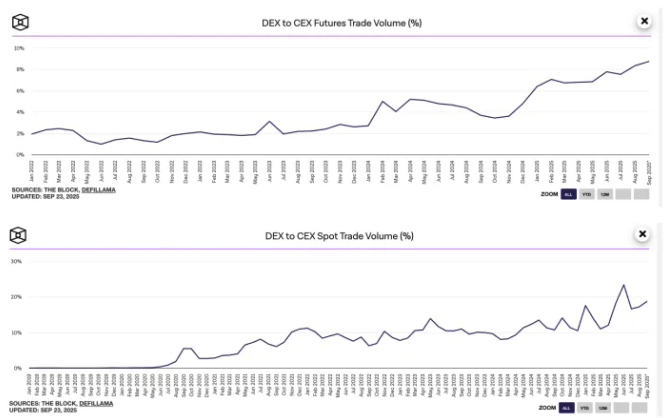

Yet, derivative DEX volume still represents less than 10% of CEX derivatives, showing that the sector remains early-stage with vast headroom.

This means that high-performance, verifiable, structured derivatives models still have multi-fold growth potential.

Projects combining independent architecture, chain-level optimization, and ecosystem synergy — such as PopChain’s PFDEX — are perfectly positioned at this structural turning point.

This de-trusted trend is not accidental; it’s the inevitable outcome of technical maturity and shifting risk preferences.

More capital is moving on-chain, and more institutions are seeking auditable, non-custodial solutions.

The DEX growth curve mirrors the early Internet’s de-platformization — slow at first, then explosive.

If growth is now a certainty, structural differentiation is where the intrigue lies.

As of August 2025, CoinGecko reports that the top 10 DEXs account for 95% of market share, with Uniswap and PancakeSwap together holding around 65%.

| Rank | Platform | MKT Share |

| 1 | Uniswap | 35.9% |

| 2 | PancakeSwap | 29.5% |

| 3 | Aerodrome | 7.4% |

| 4 | Hyperliquid | 6.9% |

| 5 | Orca | 6.6% |

| 6 | Meteora | 4.3% |

| 7 | Raydium | 4.1% |

| 8 | Curve | 2.9% |

| 9 | Sunswap | 1.4% |

| 10 | Maverick | 1.2% |

This is a classic duopoly:

Uniswap anchors liquidity in the Ethereum ecosystem, while PancakeSwap dominates retail flow within the BNB Chain.

But this apparent stability masks new openings —for while DEX volume is concentrated, quality remains underdeveloped.Most leading protocols remain confined to AMM spot markets,limited by EVM throughput, unable to support high-frequency derivatives.Liquidity fragmentation, cross-chain isolation, and sub-par UX —complex wallets, high slippage, visible latency — all persist.

Thus, the ecosystem is not yet complete.

Performance, derivative structuring, and ecosystem integration remain unconquered high ground — and challengers are emerging.

2025 marks the dawn of Performance-Era DEXs:

- Hyperliquid achieves near-CEX matching speeds through full on-chain order books.

- Aerodrome leverages the Base ecosystem to enhance stablecoin LP yield.

- *Raydium and Meteora on Solana rebuild liquidity in high-concurrency environments.

Data confirms this shift:

The ratio of DEX / CEX volume now stands at 20% for spot, and 8% for perpetuals,

with Perp DEX share surging since mid-2024.

When Hyperliquid broke out in 2023, it effectively declared the start of the Perps DEX era.

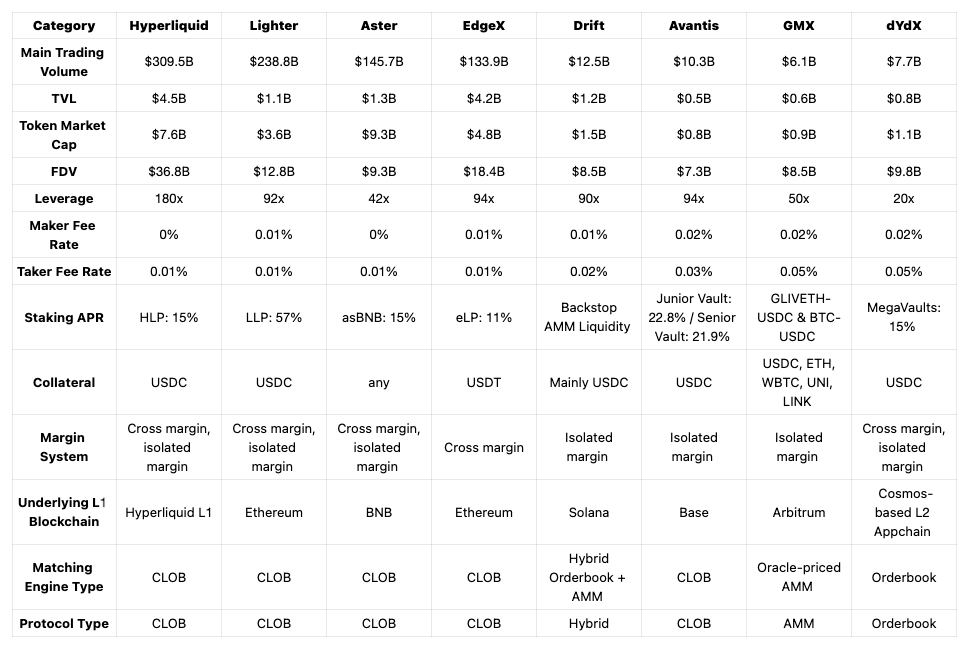

The world’s Top 10 Perps DEXs share one thing in common — architectural innovation that breaks homogenization.

Thus, the real contest is no longer who launches first or who has more users,

but who can achieve simultaneous breakthroughs in performance, structure, and ecosystem integration.

Latecomers are no longer followers — they may become the new standard-setters.

Within this structural shift, PopChain’s PFDEX chooses a precise entry point.

It is not another Uniswap,

but a fundamental redefinition of what high-performance derivatives trading means.

PFDEX’s design logic unfolds in three layers:

- Performance Layer:

Built atop PopChain’s high-performance L1 architecture, PFDEX employs parallel execution and a hybrid matching mechanism —

off-chain matching with on-chain settlement, delivering sub-second latency with full verifiability.

Clearing, margin, funding rates, and liquidations are all on-chain and transparent. - Product Layer:

PFDEX expands derivatives beyond traditional finance — including Hash Power Futures, AI Data Indices,

and Content / Social Behavior Options, turning behavior and cognition into tradable assets. - Ecosystem Layer:

PFDEX is not a standalone venue but the financial hub of the PopChain ConnectFi network.

It integrates with PenFolds (liquidity cycles) and Probly (prediction markets), feeding trading data back into the token economy, uniting governance, incentives, and risk control.

When legacy DEXs remain limited by performance and structural constraints,

PFDEX, built on a performant L1 and guided by the ConnectFi philosophy, opens a new coordinate system —from financial efficiency to social connectivity, and from trade execution to ecosystem resonance.

The evolution of DEX is a march from tool to system:

The early DEX solved trading and liquidity aggregation — functional stage.The mid-era DEX became a liquidity hub — market stage.The future DEX will be ecosystemic — the capital coordination layer of the on-chain economy,simultaneously serving content, compute, prediction, governance, and social finance.

PFDEX is emerging as a prototype of this transformation.

By integrating with PopChain’s DID and Reputation systems, PFDEX not only provides decentralized derivative services but also establishes an identity-driven credit framework at the trading layer — where a user’s reputation, activity level, and trading history directly influence their leverage limits, fee discounts, and reward distribution.

This mechanism transforms trading from a mere action into a process of credit building.

In this sense, PFDEX transcends the boundaries of traditional DEXs and functions more like an on-chain economic coordination engine.

This also explains why high-performance L1 blockchains are viewed as the key to the future of DEXs:

only when the underlying layer is strong enough can it support a wide variety of derivative contracts;

only when cross-chain interoperability is robust enough can it sustain capital flow across ecosystems;

and only a chain like PopChain, which simultaneously supports identity systems, content ecosystems, and financial modules,

can truly transform a DEX from a financial tool into value infrastructure.

The deployment of PFDEX marks PopChain’s evolution from a social-content chain into a true financial-sovereignty chain.

On this chain, every transaction, every prediction, and every content contribution made by users becomes a new economic datapoint.

These data points feed back into the PopChain governance layer, reinforcing the token economy and enabling more precise ecosystem-wide incentives —

this is the true manifestation of ConnectFi.

The decentralized derivatives sector has yet to reach its ceiling.

While Uniswap and PancakeSwap dominate liquidity, they represent the first generation of trading markets;

PFDEX, by contrast, represents the second generation of ecosystem markets — focusing not merely on trading depth, but on system coordination.

CEXs trade speed for user experience, while DEXs earn trust through openness and transparency.

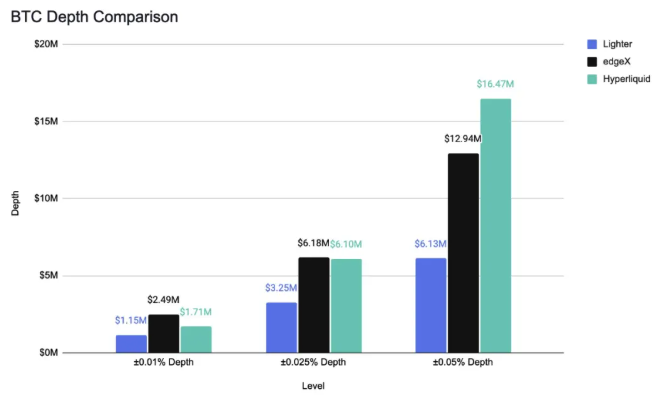

For example, BTC trading volume across the top three Perpetual DEXs has already approached $40 million,

a scale that can no longer be ignored.

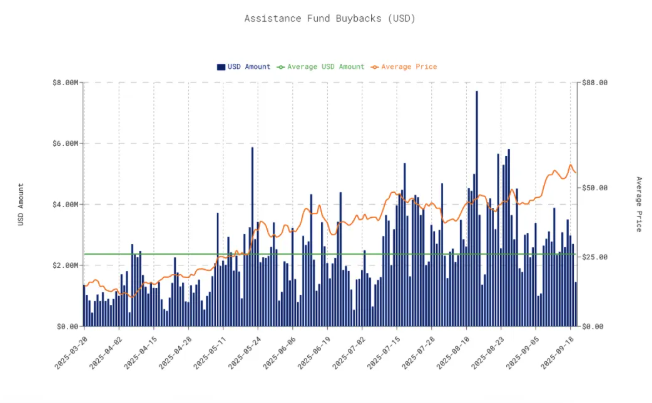

The surging trading volume also provides strong value support for the platform’s native token. For example, on Hyperliquid, 97% of trading fee revenue is directed into the Assistance Fund, which continuously buys back HYPE on the secondary market.

PFDEX is pursuing exactly this path — while also working to fuse the advantages of CEX and DEX: retaining the transparency and autonomy of decentralization, while leveraging L1-level performance and ecosystem integration to rebuild CEX-grade efficiency and user experience.

PFDEX: Reshaping Capital Efficiency and Market Order

In the evolution of the crypto market, liquidity is no longer the only moat.

What will truly define the destiny of the next-generation DEX is the synergy between capital efficiency and market order.

In past cycles, CEXs achieved efficiency through centralized matching and credit guarantees, while DEXs built their narrative on openness, transparency, and the reconstruction of trust.

However, this opposition between the two models is being dismantled by PFDEX’s “high-performance on-chain coordination mechanism.”

PFDEX’s logic is not to replicate the CEX, but to replace intermediary credit with base-layer architecture.

Through PopChain’s parallel execution framework and cross-chain state synchronization, matching and settlement are restructured: off-chain matching provides speed, while on-chain settlement ensures trust — together achieving verifiable high performance.

This design not only reduces settlement costs but also allows liquidity to be automatically routed across chains, forming a liquidity network instead of isolated liquidity pools.

In terms of capital efficiency, PFDEX introduces a Composable Margin Architecture.

Different assets’ risk coefficients, correlations, and volatilities are dynamically factored into collateral calculations, allowing higher utilization while maintaining safety margins.

Preliminary models show that during high-volatility periods, this composable margin system can improve overall capital efficiency by approximately 40%–55%;

in low-volatility environments, through risk-offset mechanisms, it can further reduce inactive margin ratios to below 20%.

The significance of this structured mechanism lies in the fact that capital is no longer passively locked — it becomes a circulating, productive asset.

Market makers on PFDEX can perform high-frequency intraday matching, while dynamically adjusting leverage and risk parameters, thus maintaining market depth and stability at lower operational costs.

For institutional participants, this means the capital turnover rate on DEXs can finally approach traditional derivatives markets, with annualized capital efficiency expected to exceed 18%, and for some high-liquidity hedging pairs, potentially reaching over 25%.

This improvement in capital efficiency ultimately feeds back into market order optimization. The boundaries between traders and the clearing layer, risk pools and incentive layers, are now quantified, transparent, and recorded on-chain in real time, bringing the logic of “risk assumption and reward distribution” back to the market itself.

This institutionalized verifiability turns PFDEX into more than just a derivatives exchange — it becomes an autonomous financial system in its own right.

In the future, as more asset types — including Hash Power, AI Data Indices, and Behavioral Options — are incorporated into the PFDEX framework, DeFi will fully enter the era of “structured yield” — where profit no longer stems from isolated incentives, but from the synergistic efficiency of the entire ecosystem.

DEX and the Reconstruction of Trust

Another major trend in the DeFi market is the reconstruction of trust structures.

Between 2024 and 2025, due to liquidity incidents, opaque clearing, and regulatory constraints at centralized exchanges, more than $38 billion in capital migrated from CEXs to on-chain self-custody protocols.

Roughly 55% flowed into stablecoins and staking assets,

25% into DeFi derivatives protocols, and the remainder into RWA and hash power finance sectors.

This shift reveals a clear message: users are replacing brand trust with transparency.

According to a Messari survey, in Q2 2025, over 62% of institutional investors stated they prefer auditable on-chain clearing systems,

a figure that was below 30% in 2022.

At the same time, the maturation of on-chain risk management and governance models has transformed DEXs from mere technological products into institutionalized, verifiable markets.

The construction of on-chain trust relies on three pillars:

- Algorithmic Trust — Rules are executed automatically by smart contracts, ensuring no human interference.

- Social Trust — Built through DID systems, reputation scores, and node governance, spreading credibility across the network.

- Economic Trust — Maintained by insurance pools, risk control funds, and composable margin models that stabilize the system.

From the data, protocols with multi-dimensional trust systems exhibit capital retention rates approximately 35%–40% higher than the industry average.

For example, Hyperliquid’s capital retention rate reaches 82%, where as small and mid-sized DEXs using single-layer clearing and non-reputation mechanisms average only 47%.

This indicates that institutionalized trust is now translating directly into capital efficiency.

When algorithms and reputation converge, trust gains a compound effect —and this is precisely the essence of the ConnectFi framework:

Finance is no longer merely transactional, but a natural extension of social structure.

Under this logic, behaviors once considered separate — trading, identity, compute, content, and prediction —are unified within a single trust network, forming a multi-source collaborative economy.

From this perspective, the next phase of DeFi is not a battle of isolated sectors, but a reconfiguration of ecosystem capital.

The PopChain ecosystem — encompassing PFDEX, PenFolds, Probly, and Luma — is a representative example of this transformation. Within a unified value framework, hash power yields drive trading demand, trading activities feed back into incentive pools, while prediction and content markets generate new data assets —together forming a self-reinforcing “connected financial system.”